Table of Contents

Introduction. 2

Definition and overview of blockchain technology. 2

Importance of blockchain in finance management. 2

Purpose of the presentation. 2

Understanding Blockchain. 2

Basics of blockchain technology. 2

Distributed ledger. 2

Decentralization. 3

Cryptography. 3

Key components of a blockchain. 3

Blocks. 3

Transactions. 3

Consensus mechanism.. 3

Different types of blockchains. 3

Public blockchains. 3

Private blockchains. 3

Consortium blockchains. 3

III. Implications of Blockchain in Finance Management. 3

Enhanced Security and Transparency. 3

Immutable records and tamper resistance. 3

Auditability and traceability. 3

Efficient and Cost-Effective Transactions. 4

Eliminating intermediaries. 4

Faster settlements and reduced transaction costs. 4

Smart Contracts and Automation. 4

Introduction to smart contracts. 4

Streamlined processes and reduced paperwork. 4

Fraud Prevention and Risk Mitigation. 4

Increased trust through consensus. 4

Improved identity verification and KYC processes. 4

Use Cases of Blockchain in Finance Management. 4

Cross-Border Payments and Remittances. 4

Supply Chain Finance. 4

Trade Finance and Letters of Credit. 4

Asset Tokenization and Securities Trading. 4

Peer-to-Peer Lending and Crowdfunding. 5

Insurance Claims and Underwriting. 5

Challenges and Considerations. 5

Scalability and performance issues. 5

Regulatory and legal concerns. 5

Interoperability between different blockchains. 5

Privacy and data protection. 5

Future Outlook. 5

Emerging trends and developments. 5

Collaboration between traditional finance and blockchain. 5

Potential impact on financial institutions and intermediaries. 5

VII. Conclusion. 5

Recap of key points. 5

Summary of blockchain's implications on finance management. 6

Potential benefits and opportunities. 6

Closing remarks. 6

I. Introduction

A. Definition and overview of blockchain technology

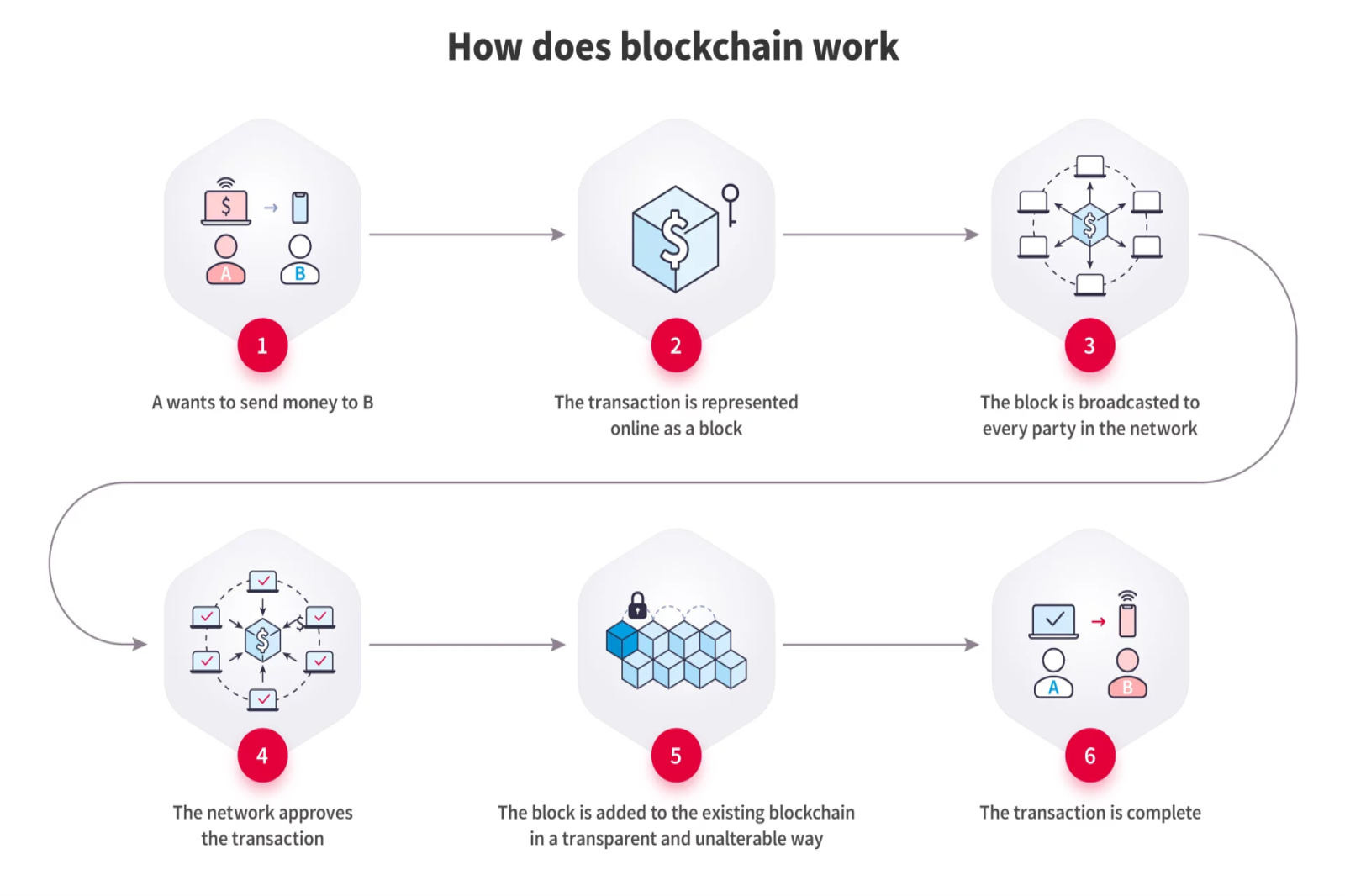

Blockchain technology is a decentralized and distributed ledger that records transactions across multiple computers. It enables secure and transparent transactions without the need for intermediaries.

B. Importance of blockchain in finance management

Blockchain has significant implications for finance management. It enhances security, reduces costs, automates processes, and mitigates fraud risks, transforming the way financial transactions are conducted.

C. Purpose of the presentation

The purpose of this presentation is to provide an understanding of blockchain technology and its implications in finance management. We will explore the key components of blockchain, its benefits, and various use cases in the financial industry.

II. Understanding Blockchain

A. Basics of blockchain technology

1. Distributed ledger

Blockchain utilizes a distributed ledger, where multiple participants maintain and validate the transaction records collectively. This eliminates the need for a central authority and enhances trust.

2. Decentralization

Blockchain operates in a decentralized manner, meaning no single entity has control over the entire network. This ensures transparency, resilience, and reduces the risk of a single point of failure.

3. Cryptography

Blockchain uses cryptographic techniques to secure transactions and ensure data integrity. It employs cryptographic hash functions and digital signatures to authenticate and protect the information stored on the blockchain.

B. Key components of a blockchain

1. Blocks

Blocks are the building blocks of a blockchain and contain a set of transactions. Each block is linked to the previous block through a cryptographic hash, forming a chain of blocks.

2. Transactions

Transactions represent the exchange of assets or information on the blockchain. They are recorded in blocks and are typically validated by network participants through a consensus mechanism.

3. Consensus mechanism

Consensus mechanisms ensure agreement among network participants on the validity of transactions. It enables trust and prevents fraudulent activities. Common consensus mechanisms include Proof of Work (PoW), Proof of Stake (PoS), and Practical Byzantine Fault Tolerance (PBFT).

C. Different types of blockchains

1. Public blockchains

Public blockchains are open and accessible to anyone. They are maintained by a decentralized network of participants, and anyone can join the network, validate transactions, and create blocks. Bitcoin and Ethereum are examples of public blockchains.

2. Private blockchains

Private blockchains are restricted to a specific group of participants. They provide privacy and control over the network, making them suitable for enterprises and organizations. Access to the blockchain is permissioned, and participants are often known entities.

3. Consortium blockchains

Consortium blockchains are a hybrid between public and private blockchains. They are operated and maintained by a consortium or a group of organizations that have shared control over the network. Consortium blockchains offer a balance between openness and control.

III. Implications of Blockchain in Finance Management

A. Enhanced Security and Transparency

1. Immutable records and tamper resistance

Blockchain's immutability ensures that once a transaction is recorded on the blockchain, it cannot be altered or deleted. This provides a high level of security and reduces the risk of fraud and tampering.

2. Auditability and traceability

Blockchain's transparent nature enables easy auditing of transactions. Each transaction is recorded on the blockchain, creating an auditable trail of activities. This enhances transparency and accountability in financial transactions.

B. Efficient and Cost-Effective Transactions

1. Eliminating intermediaries

Blockchain eliminates the need for intermediaries, such as banks or clearinghouses, in financial transactions. This reduces costs, speeds up processes, and enables direct peer-to-peer transactions.

2. Faster settlements and reduced transaction costs

Blockchain enables near-instantaneous settlements compared to traditional systems that may take days. It also reduces transaction costs by removing intermediaries and streamlining processes.

C. Smart Contracts and Automation

1. Introduction to smart contracts

Smart contracts are

2. Streamlined processes and reduced paperwork

Smart contracts automate and streamline various financial processes, eliminating the need for manual paperwork and reducing human errors. This increases efficiency and accelerates transaction processing.

D. Fraud Prevention and Risk Mitigation

1. Increased trust through consensus

Blockchain's consensus mechanisms foster trust and prevent fraudulent activities. The distributed nature of blockchain ensures that transactions are verified by multiple participants, reducing the risk of fraud or manipulation.

2. Improved identity verification and KYC processes

Blockchain technology can enhance identity verification and Know Your Customer (KYC) processes. It allows for secure storage and sharing of verified user data, reducing the risk of identity theft and fraud.

IV. Use Cases of Blockchain in Finance Management

A. Cross-Border Payments and Remittances

Blockchain facilitates faster and cheaper cross-border payments by eliminating intermediaries, reducing fees, and providing real-time transaction tracking.

B. Supply Chain Finance

Blockchain enhances supply chain finance by enabling transparent and secure tracking of goods, verifying authenticity, reducing fraud, and streamlining payment processes.

C. Trade Finance and Letters of Credit

Blockchain simplifies trade finance by digitizing and automating the processing of letters of credit, reducing paperwork, and improving trust among participants.

D. Asset Tokenization and Securities Trading

Blockchain enables the tokenization of assets such as real estate or artwork, making them divisible and tradable. It enhances liquidity, simplifies ownership transfer, and reduces intermediaries in securities trading.

E. Peer-to-Peer Lending and Crowdfunding

Blockchain platforms facilitate peer-to-peer lending and crowdfunding by connecting borrowers directly with lenders, automating loan agreements, and providing transparency and auditability.

F. Insurance Claims and Underwriting

Blockchain streamlines insurance processes by automating claims processing, reducing fraud through transparent records, and improving underwriting accuracy through access to verified data.

V. Challenges and Considerations

A. Scalability and performance issues

Blockchain faces challenges in scaling to accommodate a large number of transactions and maintaining performance. Solutions like layer-two protocols and sharding are being explored to address these challenges.

B. Regulatory and legal concerns

Blockchain's decentralized nature raises regulatory and legal concerns, such as data privacy, cross-border transactions, and compliance with existing financial regulations. Regulatory frameworks need to evolve to address these issues.

C. Interoperability between different blockchains

Interoperability between different blockchains is essential for seamless integration and exchange of assets and information. Efforts are underway to develop standards and protocols for interoperability.

D. Privacy and data protection

While blockchain provides transparency, preserving privacy and protecting sensitive data is crucial. Privacy-enhancing technologies like zero-knowledge proofs and secure multiparty computation are being developed to address these concerns.

VI. Future Outlook

A. Emerging trends and developments

Emerging trends include the integration of blockchain with other technologies like artificial intelligence, Internet of Things, and decentralized finance (DeFi). These developments have the potential to revolutionize finance management further.

B. Collaboration between traditional finance and blockchain

Traditional financial institutions are exploring blockchain technology and collaborating with blockchain startups to leverage its benefits. Partnerships and consortia are being formed to drive innovation and adoption in the financial industry.

C. Potential impact on financial institutions and intermediaries

Blockchain has the potential to disrupt traditional financial institutions and intermediaries. They will need to adapt and innovate to remain competitive in a decentralized and digitally transformed financial landscape.

VII. Conclusion

A. Recap of key points

Blockchain technology is a decentralized and transparent ledger that offers enhanced security, efficiency, automation, and fraud prevention in finance management.

B. Summary of blockchain's implications on finance management

Blockchain technology improves security, reduces costs, stream

C. Potential benefits and opportunities

Implementing blockchain in finance management can lead to reduced transaction costs, faster settlements, improved fraud prevention, and increased efficiency and transparency, unlocking new opportunities for innovation and growth.

D. Closing remarks

Blockchain technology has the potential to reshape the finance industry by revolutionizing how transactions are conducted, recorded, and verified. Embracing blockchain's capabilities can drive a more secure, efficient, and inclusive financial ecosystem.

POST COMMENT

COMMENTS(0)

No Comment yet. Be the first :)